>JK Harris Settlement Foutaise (Pardon My French)

on February 18, 2009 at 1:11 am Let’s start on a positive note. I Googled the search terms “I Love JK Harris” to see if I could find any positive press about them. This is the ONLY “press release” I could find:

Let’s start on a positive note. I Googled the search terms “I Love JK Harris” to see if I could find any positive press about them. This is the ONLY “press release” I could find:

And there are also numerous positive testimonial segments on the JK Harris website you can read by clicking here.

So, how did you find me? JK Harris complaints? J K Harris testimonials? J.K. Harris feedback? JK Harris client stories? JK Harris nightmares? Just curious.

Our family could really use that $5,000 we were expecting any day now from the class action lawsuit against JK Harris Company.

Back in 2004, a former insurance agent buddy joined the J.K. Harris sales team in our area. He approached me knowing that Katelynn and I got behind in our taxes in 2001 and 2002 due to a very slow start in our new self-employment ventures. I referred to that in an earlier post. We thought about it for awhile, because it was way too pricey for us at that time: $2,500 a piece [arbitrated], plus tax preparation charges [all unfiled years], and financial planning charges [future expense budgeting, etc].

We waited a few years to see if we could “catch up later”.

Uncle Sam caught up with us (naturally). They wanted their back taxes, all of it NOW. Plus interest. Plus penalties. What started out at about $5,500 owed was in to the $20K area now.

I called my friend at his J.K. Harris number. He’s no longer with J.K. Harris. He wouldn’t explain why, just selling truck accessories now. OK. What next? “Call my replacement…”

We called her and made an appointment to meet her at her office in Temple, Texas (no longer there today) this was the summer of 2004.

We showed up but she didn’t. Door locked. No markings on the door (in an office tower). But the office number was right.

I won’t mention her name. But she bragged about being related to a former Texas governor. We did manage to reschedule and meet her in her makeshift office in Temple. I say make shift because it appeared that she was definitely renting a small office. Very sterile room, no photos, a desk, three chairs, and boxes. I didn’t ask questions. The TV commercials somehow gave me something to trust.

We were ignorant and scared, signed our lives away. And the J.K. Harris rep definitely played on those fears. $2,500, plus tax preparation services (they can’t make an offer in compromise until all your past tax forms have been filed–that’s how they get you up front). And financial planning services. Big down payments, and large monthly payments? How much will you offer to settle for? We’ll find out in “typically 6 months” assured the rep. I hope it’s not much, because we spent what little we had saved up to pay JK Harris.

After months of dropped balls at J.K. Harris, new case workers every 3 months (with no phone call follow ups from them, or returned calls or emails), and more and more scary letters from the Internal Revenue Service, I gave up and said, “I will go fix this myself”. To be fair, there were a dozen or calls between us and J K Harris tax prep people (the beginning of the process). But any mistakes made, according to them, “are your fault, you agreed to… and also….” No ma’am, check this email, that email… ” Then I’d get a new preparer. The other ones, they claimed, were ‘promoted, sick, unavailable, yadda yadda yadda’.

OH YOU WILL LOVE THIS: Numerous IRS agents told us pretty much the same thing: “If you are able to pay back taxes from property, assets, family loans, stocks, liens, levies, … YOU WILL PAY IT ALL BACK. What the I.R.S. website has to tell you about Offer In Compromise, click here.

My experienced advice today: Hire an “enrolled agent CPA”, work it out with the I.R.S. IMPORTANT: ASK THE C.P.A. IF THEY ARE AN ENROLLED AGENT!

I’ve heard horror stories from others, however the IRS agents we dealt with in person and on the phone were very willing to help us, and surprisingly friendly. They didn’t threaten. They didn’t talk down to us. Gave us extensions until we could get it all straightened out. The enrolled agent found deductions we didn’t know about. It cost us about $100 in CPA fees per tax year.

We worked out an AFFORDABLE payment plan with the I.R.S. Got our back taxes RE-filed correctly. Today, we’re mostly good… considering how our fears nearly put me us in the poorhouse. Our monthly back tax payments are around $300 per month. No more letters or calls from Uncle Sam. Any tax refunds or credits go towards our back taxes. I can live with that. I screwed up, I’ll pay for my mistakes. And I’m back to doing my civic duty, which helps me sleep a little better.

I considered suing J.K. Harris for our money back. My attorney is a junk yard dog. He sued the the third (now) largest radio corporation in the U.S. and got my employment contract payed off.

Anyway… Just when I was about to take it to my attorney I get a letter in the mail inviting me to join a CLASS ACTION LAWSUIT against the company. WE ARE IN. We sent in copies of our contracts and waited. Couldn’t sue J K Harris anyway (in the original contract). Why would any sane person sign a transaction agreement that reads “you cannot bring suit against us”? Scared ones, that’s who. And I’m an insurance agent. Contracts are my livelihood. What keeps people from suing me? Full disclosure, ethical selling practices, and PROMPT CUSTOMER SERVICE.

We waited.

And waited.

And waited.

I think it was maybe two years ago when we were first contacted by the class action law firm. I wish I would have found THIS gentleman in California’s nightmare article regarding his experience with J.K. Harris before I threw my savings away*. (Thanks Eric for adding this post to your awesome article).

The sad ending is that we lost our hard-earned funds. All gone. Well…

Katelynn and I both got a check TODAY for our first class action suit settlement payment. $14.53! Fourteen Dollars and Fifty Three Cents. Gross. I’ll be taxed of course for that “income”.

This generous payment was attached to a really lame explanation letter:

=============================

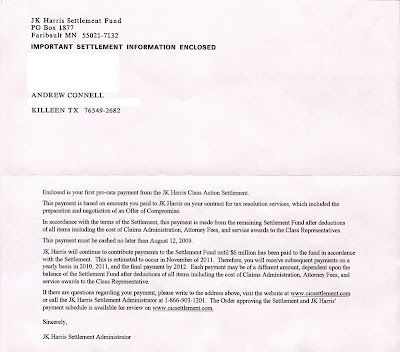

Enclosed is your first pro-rata payment from the JK Harris Class Action Settlement.

This payment is based on amounts you paid to JK Harris on your contract for tax resolution services, which included the preparation and negotiation of an Offer of Compromise.

In accordance with the terms of the Settlement, this payment is made from the remaining Settlement Fund after deductions of all items including the cost of Claims Administration, Attorney Fees, and service awards to the Class Representatives.

This payment must be cashed no later than August 12, 2009.

JK Harris will continue to contribute payments to the Settlement Fund until $6 million has been paid to the fund in accordance with the Settlement. This is estimated to occur in November of 2011. Therefore, you will receive subsequent payments on a yearly basis in 2010, 2011, and the final payment by 2012. Each payment may be of a different amount, dependent upon the balance of the Settlement Fund after deductions of all items including the cost of Claims Administration, Attorney Fees, and service awards to the Class Representative.

If there are questions regarding your payment, please write to the address above, visit the website at http://www.oicsettlement.com/ or call the JK Harris Settlement Administrator at 1-866-903-1201. The Order approving the Settlement and JK Harris’ payment schedule is available for review on http://www.oicsettlement.com/.

Sincerely,

JK Harris Settlement Administrator

====================================

The only winners from the lawsuit are the attorneys and the administrators. I can’t sue or “arbitrate” against J K Harris Company now because I “participated” in the class action lawsuit. At least the 1st amendment allows this post.

Take the money you plan to pay a tax settlement firm and use it to hire an “enrolled agent CPA” to re-do your taxes, find your mistakes, and work out a payment plan with the I.R.S. Hell, with the new administration, there may even be more relief in sight for back-tax-owers.

I did get a “timely” email the other day from one of our Republican lawmakers working on legislation that will do away with back tax interest and late penalties. I know it won’t pass, but all the BS or FOUTAISE is starting to catch up with them.

If you’ve had a bad experience with J.K. Harris (or considering hiring any tax settlement firm) please research it all on Google first — and leave a comment below! You are wiser than I was. You’ve found this post in your quest to check out J K Harris or other tax settlement firms.

I could actually write so many PAGES about this nightmare here, but as I look over what I’ve posted so far, I’m very depressed about it all over again. So I’ll wrap up.

If my $5,000 loss keeps you from taking your tax fears and hopes to an outside tax relief firm… then it is money well spent for us.

One last thing. After we made our payout agreement with the IRS, I called two other tax relief firms (from TV ads). Both times, the firm reps told me “you got a good deal worked out for yourself, we couldn’t possibly work out a better settlement for you.” At least those two reps were honest (though pissed about my probing, educated questions).

Paying estimated taxes every quarter is a challenge for us, but it’s the law. And it’s theirs, for now. If you find yourself falling short, contact the IRS…” stop the leak before there’s a flood”. They’d rather work with you now, when it’s within your grasp, than when it’s out of control and they have to start putting liens and levies on everything. If you don’t respond to their letters… it IS a response: the wrong one.

*You may wonder if we had money in savings, why didn’t we use it to pay back taxes. I always tried to put away 6 months living expenses away in case of a radical financial emergency. I considered it untouchable… later… I considered hiring J K Harris “a radical financial emergency”. You’re absolutely right. It would have saved us THOUSANDS to use that money to pay our taxes ON TIME.

Follow me: Twitter – Facebook – YouTube – My Twitter management tool – Subscribe to Feeds

>jk harris sucks they should ALL be tarred and feathered shame on them They put me threw more pain than the IRS

>What are the proper steps in suing JK Harris? I have been waiting for a good year now on a refund check…no calls from them and stupid excuses for their delay.

>OMG you guys are not alone! My husband and I over paid by 3500.00 and the IRS left us alone until JK f**ktards sent the IRS a letter saying they are no longer representing us. No kidding here according to JK harris we owed 30k according to H and R block we were due refunds for all the years. We are still trying to figure out how the irs got the numbers they did, since we never signed any tax forms with JK harris. We prey the IRS will come to their senses and go over all of our tax forms with a fine tooth comb. Word to the wise here JK Harris is full of lies and one day they will be sued for their lies and I will be standing in line for that. Jacksonville, FL area beware! I would like to picket this office myself let me tell you. Their scare tactics are crap when they don't even know the correct irs forms to fill out. If we end up owing 16k like the IRS seems to think, I plan on suing JK Harris for the full amount plus interest! CON MEN THE LOT OF THEM DO NOT USE JK HARRIS EVER!!!

>Your story is identical to mine only the JK Harris Rep that handled my case after it was lost for a year told me not to file my taxes. After offer after offer, and years of waiting, I started to get on my feet again. the IRS deemed me able to repay the whole amount. $1700 to JK Harris on $5,500 in back taxes turned into $20,00 in penalties and interest. Pardon me but I would gladly place a fist to face of many of these scammers. MARLENEY HAYWOOD at JK Harris gave me the run around for years at this company and the person I hold personally responsible for my hardship. To top it off I never received the first check from 2009 and it is now Feb 2010! gsoren22770@yahoo.com. I will respond to any inquary.

Pissed in WISCONSIN

>The article above is excellent. It is creepy how similar that persons situation was to my own. J.K. Harris is a complete scam. Please take the advice above.

>I too only received one check from the settlement over a year ago for some feeble amount of $15.00. I paid J.K. Harris over $5,000 to aid in repairing my credit and make amends only to be let down. Then the Justice system did the same "let down" by allowing a Judge a "cartwheel" judgment for J.K. Harris toease out of their responsibilities with such a meager settlement. I can almost speculate that Harris will come up with some kind of "extension request" and claim they will go bankrupt if they have to pay the whole settlement by 2011. All the satisfaction I can get is telling everyone I meet about the whole scenario and let people make their own choice in choosing a tax service company. As of this date, I know I talked to over 65 people, couples or families about what happened to me and as far as I know, none of them hired Harris for their tax service provider. It gives me great satisfaction that I probably took over 300,000 of business away from those bastards. Hopefully, more people will read this and not go with Harris and maybe my goal of a million will be reached.

>It sounds like the settlement was for JK Harris to pay 1.5 million per year, for four years. Sounds like a lot of money?… Well, 80% is taken by the lawyers, leaving $300,000. Then if that is divided among 20,000 people.. it's a check for $15 each per year.

JK Harris is also a winner in this. They collected around $50 million in advance fees from these 20,000 people, performed no service, can't be sued by these 20,000 people anymore, and got to keep $44 million!

I almost got scammed by JK Harris, myself. I went to an unmarked Atlanta office in 2003. (I found out later they were banned from operating in Georgia at the time). But the agent got greedy for my $2,500 and took a credit card. Then they used my Power of Attorney to finance a $5,000 loan (the ONLY thing they used it for, and TOTALLY illegal). Three months later I had been through 5 agents, and they hadn't even entered my named in their customer database.

I got off lucky… I called my credit card company and disputed the charge for 'no service rendered'.

Three months later, JK Harris sent me a letter offering to 'refund a portion of my fees' if I returned a signed agreement to never sue them. I laughed, since my credit card company had refunded ALL of money, and tossed their offer in the trash.

The continuing operation of JK Harris proves that the BB is a hoax, the goverment has no desire to protect the consumer, and television networks will take anyones advertisements…. as long as the money is up front.

>I wish I had goggled JK Harris before giving them 3,500 of my hard earned money.

I could have typed up a letter of compromise myself. Get this never filed for an appeal.

Now the IRS is hot on my trail for the full amount of $40k due next week. I’m unemployed so what next? JK Harris is nowhere to be found. JK Harris will not return my phone calls or answer any of my emails.

When I had my case worker on the phone she always had to consult with her supervisor and that she would get back with me in a few days. Yea right!!!!! What TAX professionals do they really have? They are nothing more than thieves. The law should water board the founder and send them away in prison for a long time.

I hope they realize! It's no fun when the rabbits got the gun.

If anyone has any information on how to get my money back and the best way to resolve my Tax issues with the IRS please email me at stuffthatwork1@yahoo.com

>I received a check from the settlement about a month ago ($15.75) with the same letter attached. I wonder, how much did all of the attorney receive?

>j..k.harris steels money from hard working people and they should pay them back in full

>i payed j.k.harris 5.000 dollars to help me with i.r.s. they did nothing and the i.r.s. took 22’000 dollars from me i had to pay a new lawyer he found out the i.r.s. was wrong and they had to give me back the money they took from me but j.k.harris only gave me back 22.02 out of the 5’000 i payed them how is that fare my name is HUGH DONOHUE 119 SOUTH LOCUST STREET MOUNT CARMEL,PA 17851 MY EMAIL IS BIGPOPPYTHEHAT@aol.com they s SHOULD HAVE TO PAY BACK ALL THE MONEY THEY TOOK FROM ME AND THE RESR OF US IN FULL AND THE I.R.S. SHOULD GO AFTER J.K. HARRIS AND MAKE THEM PAY IN FULL TO ALL OF US AND ALSO BE FINED BY THE GOVERMENT ALSO I THANK YOU ALL AND WE ALL GET BACK OUR MONEY

>You tell’em Crash!